Loss Control Consultants Step Into New Roles

- Author | Halie Gallik

- 2/9/2022 7:00 am

Loss Control Consultants Step into New Roles

Two of Public Entity Partners’ loss control consultants have recently moved into new positions. Bob Lynch is now filling the role of casualty consultant for Middle Tennessee, while Jim Bell Hatchel has transitioned from our underwriting department to the role of property conservation consultant for Middle Tennessee.

Bob has served as property consultant for Middle Tennessee for the past four years. In his new role, he conducts casualty surveys for members.

“I’ve spent my entire career working with local governments,” Bob said. “Before coming to PE Partners, I was blessed to serve as risk manager for the City of Cookeville, after having served many years in fire service and as a reserve police officer. The work our members do each day in serving the taxpayers of our state is important and valuable, and I am grateful for the opportunity to serve our Middle Tennessee members. If we can make a recommendation that keeps even a single employee from being injured or prevent even one lawsuit, we have made a difference to the public entity employees we serve, as well as to the taxpayers.”

Jim Bell Hatchel has served as an underwriter for East Tennessee for the past two years. In his new role, he makes recommendations to reduce the threat of physical loss to member facilities.

“Working directly with members and visiting worksites across the state is the highlight of my day,” Jim Bell said. “I am excited to transition to a role where I can work in person with members when visiting their properties. From wastewater treatment plants to playgrounds, our members have a broad range of facilities. We can work together to reduce property losses for those facilities.”

One of the ways PE Partners’ loss control team works with members is through an onsite survey. During a survey, our team makes operational recommendations that ensure we are addressing liability concerns, and reviewing previous claims against your organization to evaluate trends or potential issues. These recommendations keep your team safe and free from injuries and accidents, while also safeguarding public resources and reducing property losses.

For a casualty survey that focuses on liability and workers’ compensation, our team members may ask to see policies, police standard operating procedures, training records, insurance certificates, participation waivers and hold harmless agreements, as well as employee motor vehicle records checks and other documentation that supports your risk management program.

After a survey is completed, a survey letter is sent outlining any recommendations. A copy of the report is also provided to our underwriting team to help evaluate your exposures.

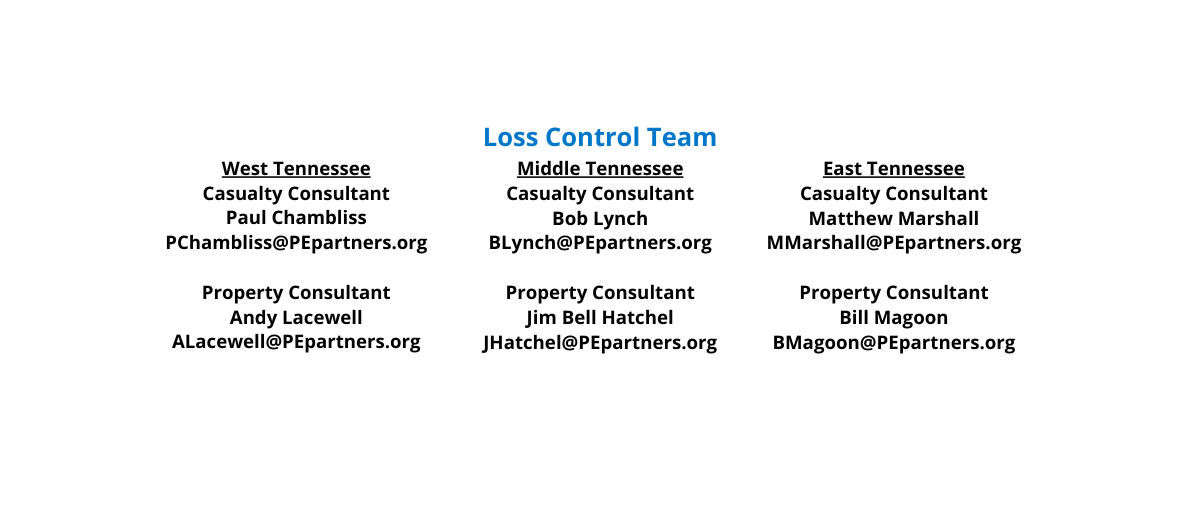

Please contact your team member if you have questions about your loss control program.

Categories

-

Annual Report

(5)

-

Audit Requests

(2)

-

Board of Directors

(19)

-

Claims

(26)

-

Cyber Extension

(4)

-

Cyber Security

(27)

-

Dividend

(7)

-

EHS Hero & HR Hero

(16)

-

Employment Practices Liability

(26)

-

Excellence In Risk Management Awards

(18)

-

Fireworks

(1)

-

First Responders

(9)

-

Grants

(23)

-

Law Enforcement

(16)

-

Local Government Risk Academy

(4)

-

Loss Control

(106)

-

Member Services

(11)

-

Message From the President

(20)

-

MTAS

(10)

-

Municipal Sewer System

(4)

-

Partnering for Success Webinar Series

(33)

-

PEP Staff

(32)

-

Qualified Immunity

(3)

-

Risk & Insurance Symposium

(42)

-

Safety Program

(56)

-

Scholarships

(20)

-

Social Media

(2)

-

Training

(78)

-

Underwriting

(32)

-

Workers' Compensation

(27)

- Annual Report (5)

- Audit Requests (2)

- Board of Directors (19)

- Claims (26)

- Cyber Extension (4)

- Cyber Security (27)

- Dividend (7)

- EHS Hero & HR Hero (16)

- Employment Practices Liability (26)

- Excellence In Risk Management Awards (18)

- Fireworks (1)

- First Responders (9)

- Grants (23)

- Law Enforcement (16)

- Local Government Risk Academy (4)

- Loss Control (106)

- Member Services (11)

- Message From the President (20)

- MTAS (10)

- Municipal Sewer System (4)

- Partnering for Success Webinar Series (33)

- PEP Staff (32)

- Qualified Immunity (3)

- Risk & Insurance Symposium (42)

- Safety Program (56)

- Scholarships (20)

- Social Media (2)

- Training (78)

- Underwriting (32)

- Workers' Compensation (27)